Pakistan Crypto Regulation

As the world rapidly moves toward digital economies, Pakistan finds itself standing at a critical crossroads. According to financial experts, Pakistani citizens have already invested between $20 billion and $30 billion in cryptocurrencies — a staggering amount for a country with no legal framework or regulatory oversight.

This lack of regulation not only exposes investors to serious risks but also poses a growing challenge to the national economy. Experts warn that unless the government acts quickly and decisively through a clear Pakistan Crypto Regulation 2025 policy, the country could miss out on one of the biggest economic opportunities of the decade.

Economic analysts argue that Pakistan’s crypto market has grown too large to be ignored. To protect investors and strengthen the financial system, the government must now develop a clear and transparent regulatory roadmap.

Key Details

| Category | Details |

|---|---|

| Estimated Investment | $20–30 billion |

| Projected Future Trading | Up to $300 billion |

| Current Status | Unregulated and informal investment activity |

| Proposed Solution | Central Bank Digital Currency (CBDC) & Regulatory Framework |

| Potential Economic Benefit | $20–25 billion in national gains |

Why Is Pakistan Crypto Regulation 2025 So Important?

When billions of dollars are invested without any laws or safeguards, risk multiplies. That’s exactly what’s happening in Pakistan’s crypto market.

Currently, no government body officially tracks or monitors crypto transactions. Without proper Pakistan Crypto Regulation 2025 policies, investors’ funds could easily be lost to scams, fraud, or illegal schemes.

However, if the government builds a solid regulatory system, the crypto industry could bring billions in new opportunities. Experts believe that timely regulation could generate $20–25 billion in additional economic value for Pakistan — boosting financial growth and restoring investor confidence.

Is Pakistan Ready for the Future of Crypto?

Experts suggest that Pakistan should take a phased and cautious approach to legalizing cryptocurrency.

With millions of internet users and a growing youth population showing interest in digital finance, the potential is undeniable.

But without strong cybersecurity and financial safeguards, the risks are equally high.

That’s why economists recommend that Pakistan first introduce a Central Bank Digital Currency (CBDC) — a digital version of the Pakistani Rupee — to make remittances and transactions faster, cheaper, and traceable under state supervision.

What Should Pakistan’s Crypto Regulation 2025 Include?

Experts at the Sustainable Development Policy Institute (SDPI) conference recommended that the government’s crypto policy include these essential steps:

- Introduce a licensing framework under the State Bank of Pakistan.

- Enforce strong cybersecurity and anti-fraud laws to protect users.

- Create a clear tax structure for crypto income and assets.

- Ban Ponzi schemes and illegal token promotions.

- Launch public awareness programs to educate citizens about crypto risks and opportunities.

Without these reforms, the rapid growth of crypto could become a national liability instead of an asset.

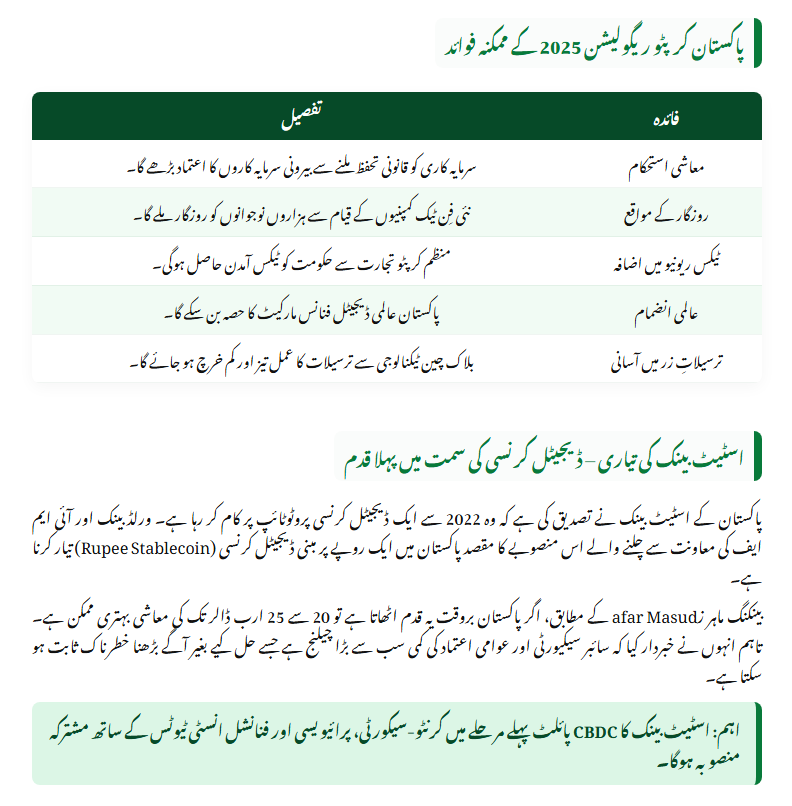

Major Benefits of Pakistan Crypto Regulation 2025

If Pakistan successfully introduces a formal crypto regulation policy, the impact could be transformational for both the economy and individuals.

| Benefit | Description |

|---|---|

| Economic Stability | Legal protection for investors will increase confidence and attract foreign capital. |

| Job Creation | Growth in fintech startups could generate thousands of new jobs. |

| Tax Revenue | Regulated trading would bring in new government income through taxation. |

| Global Integration | Pakistan could become a competitive player in the global digital finance market. |

| Easier Remittances | Blockchain-based systems could cut costs and speed up overseas transfers. |

State Bank’s Progress Toward Digital Currency

The State Bank of Pakistan confirmed that it has been developing a digital currency prototype since 2022, with support from the World Bank and IMF.

The goal is to introduce a Rupee-based stablecoin under strict supervision, paving the way for safer digital transactions.

According to Zafar Masud, President of the Pakistan Banks Association, this initiative could unlock $20–25 billion in economic gains if implemented early.

However, he also warned that cybersecurity weaknesses and low public trust remain major challenges that must be addressed before the system can go live.

What Happens If Pakistan Delays Crypto Regulation?

Delaying regulation could have serious consequences.

Countries like the UAE, Singapore, and Malaysia have already embraced crypto laws and attracted billions in global investment.

If Pakistan continues without a legal framework, local investors will keep using unregulated international platforms, increasing the risks of money laundering, scams, and capital flight.

In short, delay means danger — and the longer Pakistan waits, the harder it will be to catch up with the digital finance revolution already sweeping the world.

Conclusion

The Pakistan Crypto Regulation 2025 is not just an economic policy — it’s a national priority.

When millions of citizens are investing billions of dollars, it becomes the state’s duty to protect their money and ensure transparency.

Proper laws will strengthen investor confidence, stabilize the financial system, and position Pakistan as a credible participant in the global digital economy.

The time for hesitation is over.

If Pakistan takes bold, smart, and timely action today, it can secure its place in the future of finance — a future built on trust, technology, and transparency.

Official Website: https://www.sbp.org.pk

Frequently Asked Questions (FAQs)

Q1. How much have Pakistanis invested in crypto so far?

Experts estimate that Pakistanis have invested between $20 and $30 billion in cryptocurrencies, mostly through online platforms.

Q2. Why does Pakistan need crypto regulation now?

Without proper regulation, investors face risks like fraud, hacking, and loss of funds. Laws will bring transparency and protection.

Q3. What is the Pakistan Crypto Regulation 2025 policy?

It’s a proposed framework to legalize, monitor, and regulate cryptocurrency trading under government oversight.

Q4. Will Pakistan launch its own digital currency?

Yes. The State Bank is developing a Central Bank Digital Currency (CBDC) to modernize payments and reduce remittance costs.

Q5. What are the main benefits of crypto regulation for Pakistan?

It can stabilize the economy, create jobs, attract foreign investment, increase tax revenue, and position Pakistan in the global fintech race.

Related Posts