SECP Issues New Rules for Digital Asset Management Services

The Securities and Exchange Commission of Pakistan (SECP) has familiarized new and updated rules for Digital Asset Management Services (DAMS). These rules have been delivered through S.R.O. 1438(I)/2025 as an amendment to the Non-Banking Finance Businesses and Notified Entities Regulations, 2008. The purpose of these rules is to modernize Pakistan’s investment sector by unstable old-style asset organization toward fully digital platforms.

These new regulations guide how Digital Asset Organization Corporations (Digital AMCs) will operate, what requirements they must meet, and how investors will be served through digital stations in a safe and regulated method.

Quick Information Table for SECP Issues New Rules for Digital Asset Management Services

| Field | Details |

|---|---|

| Name of Program / Regulation | S.R.O. 1438(I)/2025 – Digital Asset Management Services Rules |

| Start / Issue Date | 2025 (as part of amended NBFC Regulations) |

| End Date | Not applicable (regulations remain in force) |

| Assistance / Scope | Rules for licensing, operating, and regulating Digital AMCs and DAMS in Pakistan |

| Application Method | Online application through SECP licensing process + submission of business plan and required documents |

What Are Digital Asset Management Services?

Basic Meaning

Digital Asset Management Services (DAMS) allow savers to access conjecture services entirely done digital means. This includes mobile apps, web gateways, connected consoles, and other digital stations used for:

- Opening investment accounts

- Viewing investment reports

- Subscribing or redeeming units

- Managing portfolios

- Customer support and updates

What Is A “Digital Platform”?

According to SECP, a Digital Platform is any request, portal, or software used as the chief border between investors and a Digital AMC. This comprises mobile apps, web stages, online aggregators, and any numerical gears used for fund distribution.

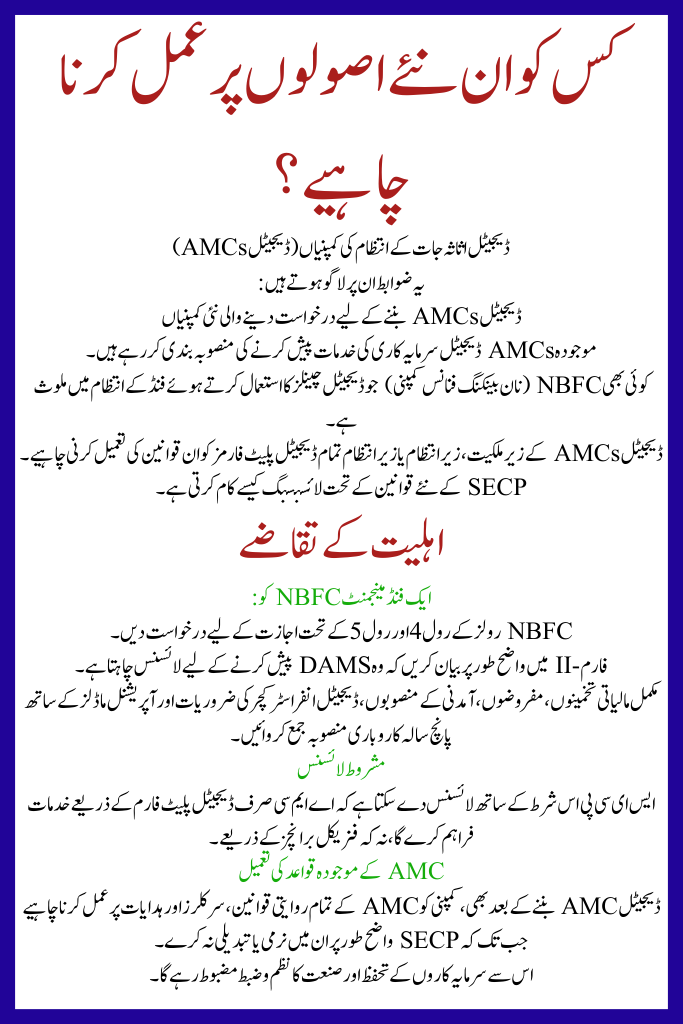

Who Must Follow These New Rules?

Digital Asset Management Companies (Digital AMCs)

These regulations SECP Issues New Rules for Digital Asset Management Services apply to:

- New companies applying to become Digital AMCs

- Existing AMCs planning to offer digital investment services

- Any NBFC (Non-Banking Finance Company) involved in fund management using digital channels

All digital platforms owned, managed, or administered by Digital AMCs must comply with these rules.

How Licensing Works Under the New SECP Rules

Eligibility Requirements

A Fund Management NBFC must:

- Apply for permission under Rule 4 and Rule 5 of NBFC Rules.

- Clearly state in Form-II that it wants a license to offer DAMS.

- Submit a five-year business plan with complete financial projections, assumptions, revenue plans, digital infrastructure needs, and operational models.

Conditional License

SECP may grant a license with the condition that the AMC will provide services only through digital platforms, not through physical branches.

Compliance With Existing AMC Rules

Even after becoming a Digital AMC, the company must follow all conventional AMC rules, circulars, and directives unless SECP explicitly relaxes or changes them.

This ensures investor protection and industry discipline remain strong.

What This Means for Investors in Pakistan

Benefits for the Public

These new rules create many advantages:

- Easy access to investments through mobile apps and online systems

- Faster processes, including account opening and fund transactions

- Lower operational costs for companies, which can lead to lower fees

- More transparency, because digital records provide clean and traceable data

- Convenience, especially for young or remote users who prefer online financial services

Risks and Precautions

Investors should also be aware of:

- Cybersecurity risks — keep passwords and personal information safe

- Verification — always check if the AMC is SECP-licensed before investing

- Financial risk — digital access does not remove investment risk; funds may still rise or fall

How This Fits Into Pakistan’s Larger Digital Finance Landscape

Not Related to Cryptocurrency

These DAMS regulations do not legalize or regulate cryptocurrency. SECP and the State Bank of Pakistan (SBP) have confirmed that cryptocurrency is still not legal in Pakistan.

Government Is Planning a Digital Assets Authority

The government is working on a distinct plan to found the Pakistan Digital Assets Authority (PDAA) for regulating virtual and digital possessions in the future.

This shows that Pakistan is touching step by step toward digital monetary directive, but DAMS is focused entirely on regulated mutual funds and asset management, not crypto.

FAQs- SECP Issues New Rules for Digital Asset Management Services

Can ordinary Pakistanis use DAMS?

Yes. Anyone can invest through a licensed Digital AMC once its digital platform becomes operational.

Will physical branches still exist?

SECP may require some AMCs to operate only digitally, depending on their license conditions.

Does this make investing cheaper?

It can. Digital operations reduce managerial costs, and SECP already covered organization fees of mutual coffers to protect investors.

Conclusion

SECP Issues New Rules for Digital Asset Management Services mark a major step toward digital transformation in Pakistan’s financial sector. With these rules, investing becomes easier, more see-through, and more nearby for everyone. Digital AMCs will make it possible for Pakistanis to achieve their savings from mobile apps or connected stages with full regulatory guard.

Related Posts