Soneri Bank and Euronet Pakistan Partnership

In a rapidly evolving financial world, digital transformation has become essential for every modern economy. Pakistan, too, is embracing this shift — and a major milestone has just been achieved. Soneri Bank Limited, one of Pakistan’s leading financial institutions, has partnered with Euronet Pakistan, a division of the global financial technology company Euronet Worldwide.

This collaboration is set to reshape Pakistan’s banking sector, modernizing its credit card systems, digital payments, and transaction networks.

The partnership represents a major step toward innovation, security, and convenience — enabling customers to experience world-class banking right here in Pakistan.

With this alliance, Soneri Bank is taking a bold stride into the future of cashless transactions, expanding access to safe, fast, and digital financial services nationwide.

Key Details

| Category | Details |

|---|---|

| Partner Institutions | Soneri Bank Limited & Euronet Pakistan |

| Partnership Model | Fully Outsourced and Managed Services |

| Objective | Modernization of Credit Card & Payments Systems |

| Features | Tokenization, Google Pay, Data Security, POS Acquiring |

| Year | 2025 |

Why Is the Soneri Bank and Euronet Partnership Important for Pakistan?

The Soneri Bank and Euronet Pakistan Partnership 2025 is a landmark development for Pakistan’s financial landscape.

Until now, digital payments in the country have lacked a unified and globally compliant framework. Euronet, being an international leader in electronic payment systems, brings advanced security, efficiency, and scalability to Pakistan’s banking infrastructure.

Through this collaboration, Soneri Bank will now offer secure, contactless, and globally integrated card services, allowing customers to enjoy faster transactions and stronger fraud protection.

The entire system will operate under PCI DSS–compliant standards, ensuring that all data and transactions remain protected.

This partnership signals the start of a new era in Pakistan’s financial digitization.

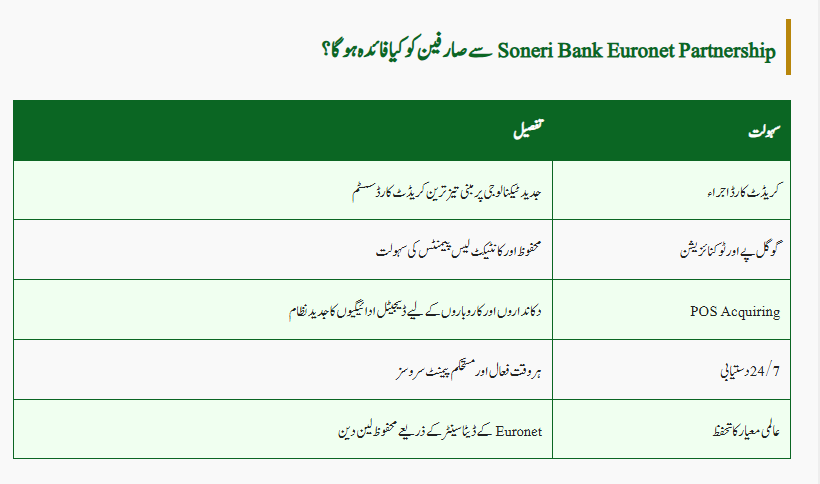

How Will Customers Benefit from the Soneri Bank Euronet Partnership 2025?

With this partnership, Soneri Bank customers will experience a range of new digital features and secure payment options.

| Feature | Description |

|---|---|

| Credit Card Issuance | Fast, secure, and technology-driven card services |

| Google Pay Integration | Contactless payments with global compatibility |

| POS Acquiring | Smart solutions for retailers and merchants |

| 24/7 Availability | Reliable transaction processing around the clock |

| Global Data Security | Managed through Euronet’s world-class data centers |

In short, this collaboration will make banking simpler, faster, and more reliable for everyday consumers as well as businesses.

What Will This Partnership Bring to Pakistan’s Economy?

The Soneri Bank and Euronet Partnership 2025 is not just about technology — it’s about economic transformation.

Digital payments reduce dependence on cash, increase transparency, and promote financial inclusion.

For businesses, it means faster transactions, fewer errors, and better record-keeping.

Experts estimate that Pakistan could unlock billions of dollars in annual economic potential by shifting to secure, cashless systems.

The move aligns perfectly with the government’s Digital Pakistan Vision 2030, which aims to create a connected and tech-driven economy.

Who Is Euronet Pakistan and How Will This Partnership Work?

Euronet Pakistan is a subsidiary of Euronet Worldwide (NASDAQ: EEFT) — a global fintech powerhouse operating in over 170 countries.

In this partnership, Euronet will provide a fully managed digital payment infrastructure, including credit card issuance, transaction processing, and POS acquiring.

All systems will be hosted in Euronet’s PCI DSS–compliant data centers, ensuring world-class reliability and security.

This model allows Soneri Bank to focus on customer innovation and product growth, while Euronet manages the complex backend technology.

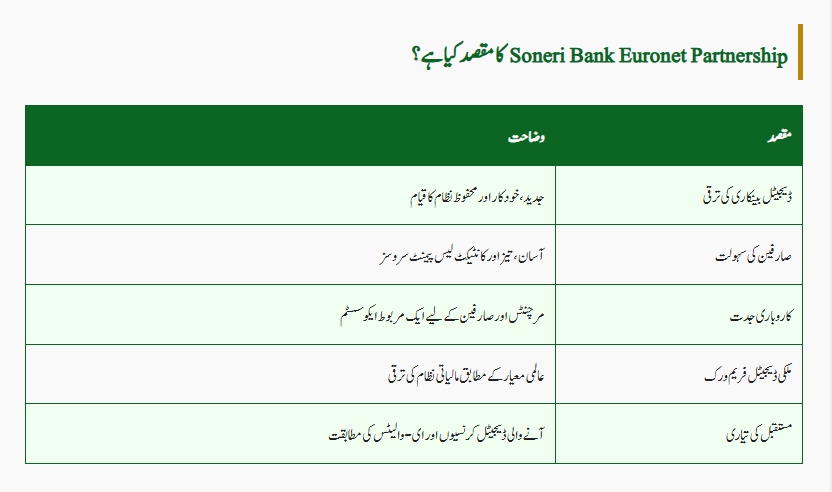

What Is the Purpose of the Soneri Bank and Euronet Pakistan Partnership 2025?

| Objective | Description |

|---|---|

| Digital Transformation | Bringing Pakistan’s banking systems into the modern age |

| Customer Convenience | Contactless, fast, and seamless payment services |

| Business Growth | Enabling merchants and entrepreneurs with smart payment tools |

| National Financial Framework | Building Pakistan’s digital economy infrastructure |

| Future Readiness | Preparing for digital currency and e-wallet integrations |

This partnership demonstrates both institutions’ commitment to long-term innovation and customer satisfaction.

How Will the Partnership Shape Pakistan’s Future Banking Landscape?

The partnership will accelerate Pakistan’s shift toward digital financial inclusion, giving millions of people access to modern banking tools. Soneri Bank aims to introduce smart credit cards, mobile wallets, and integrated digital payment solutions under Euronet’s technological guidance. This will help reduce financial inequality, empower small businesses, and boost the overall economy.

By leveraging Euronet’s global experience, Soneri Bank will be able to deliver services that meet international banking standards — a major milestone in Pakistan’s journey toward digital transformation.

Statements from Leadership on the Soneri Bank and Euronet Pakistan Partnership 2025

At the signing ceremony, senior leadership from both organizations shared their vision.

Mr. Muhtashim Ashai, CEO of Soneri Bank, stated:

“We are thrilled to partner with Euronet. This marks a major milestone in our digital transformation journey. Together, we will deliver secure, modern, and innovative payment experiences to our customers.”

Mr. Kashif Gaya, CEO of Euronet Pakistan, said:

“This long-term partnership reflects our shared vision of advancing Pakistan’s digital payment landscape through secure and scalable technology.”

Both leaders emphasized that this collaboration will help make Pakistan a regional leader in fintech innovation.

Conclusion

The Soneri Bank and Euronet Pakistan Partnership 2025 is more than a business deal — it’s a strategic move toward the future of digital finance in Pakistan. This collaboration will simplify payments, strengthen financial transparency, and bring millions of Pakistanis into the digital economy. Experts believe this partnership could serve as a model for other banks to follow, accelerating Pakistan’s journey toward a cashless, connected future. With innovation, technology, and trust at its core, this partnership will redefine how Pakistanis bank, pay, and connect with the world.

✅ Official Website: https://www.soneribank.com

Frequently Asked Questions (FAQs)

1. What is the Soneri Bank and Euronet Pakistan Partnership 2025?

It’s a strategic collaboration to modernize Soneri Bank’s credit card and payment systems using Euronet’s advanced global technology.

2. What benefits will customers get from this partnership?

Customers will enjoy secure, contactless payments, faster card services, Google Pay integration, and 24/7 reliable transactions.

3. How does this partnership support Digital Pakistan Vision 2030?

It promotes financial inclusion, reduces cash dependency, and encourages secure, tech-driven economic growth.

4. Is Euronet Pakistan a reliable technology partner?

Yes, Euronet is a globally recognized company, operating PCI DSS–compliant data centers that meet international banking standards.

5. When will customers see the new services?

Implementation is already underway in 2025, with gradual rollout of new credit card systems and digital payment features.

Related Posts